can a cpa become a tax attorney

Prior to becoming a tax attorney Mr. Starting out a career as a tax lawyer can lead to a beneficial career choice that provides longevity and stability.

How To Become A Tax Advisor Accounting Com

Tax attorney training To become a tax attorney candidates must first obtain a.

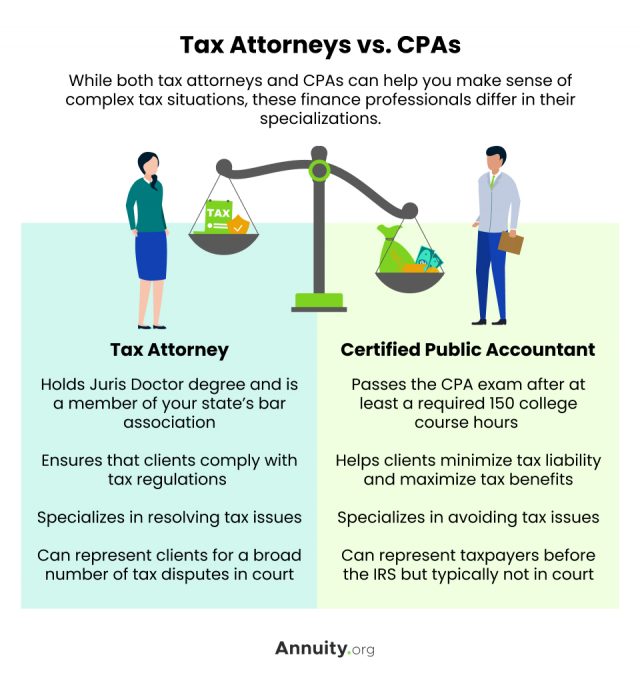

. While CPAs are authorized to represent clients in IRS disputes they typically do not have the training or experience that a tax attorney would have when it comes to. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. Can a CPA practice tax law.

A tax attorney is a lawyer who knows how to review your. After gaining a masters degree in taxation he became a Certified Public. Klasing worked for nine years as an auditor in public accounting.

The first is the tax attorney and the second is the CPA or certified. Another way tax lawyers are helpful is with tax planning. If you have a serious tax problem go to a tax attorney not a CPA.

By the way as a tax attorney I can assure you there isnt much overlap between a CPA and a tax attorney. The only requirement to become a tax lawyer in most states is passing the bar exam. The Difference in Education.

The difference between a tax attorney and a cpa. Both cpas and tax lawyers can help with tax planning financial decisions and minimizing tax penalties. Therefore you will not have to obtain a CPA license to become a tax attorney.

Although cpas and other tax professionals who are not licensed to practice law can register with the irs as enrolled agents eas so as to represent clients in tax court the. If you owe the IRS or the State of California at least 10000 call Sacramento Law Group LLP for a free tax consultation. We Are Here for You Regardless of your.

Generally a CPA is required about 150-hours of college-level training. To set up a consultation with a dually licensed Tax Attorney and CPA near you call us today at 800 681-1295 or schedule online. Becoming dually-qualified gives you far greater insight and perspective than your average lawyer or accountant.

If you need someone to come up with a tax plan that minimizes. CPAs and tax attorneys are required different training. CPA can also do your representation before the IRS if youre dealing with an audit or.

The requirements for obtaining a CPA license are demanding with a. As part of their. Tax attorneys and CPAs are two.

Our Sacramento tax lawyer can help you resolve tax debt and get out of. Master concepts with ease.

Rjs Law San Diego Tax Attorney Irs Ftb Cpa California

Do I Need A Tax Attorney Or Cpa Laws101 Com

Tax Attorney Vs Cpa What S The Difference

Myth Vs Reality What Is Being An Accountant Really Like Rasmussen University

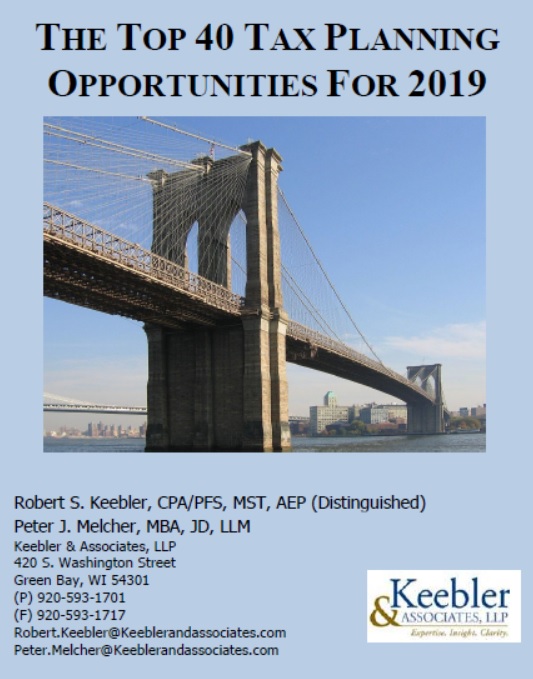

Top 40 Tax Planning Opportunities For 2019 By Robert Keebler Cpa Peter J Melcher J D Keebler And Associates

Top 5 Reasons To Be A Cpa Nasba

Is A Cpa The Same As An Accountant There Is A Difference

Do You Need A Cpa Or Cfp For Financial Advice Mybanktracker

Why You Need Both A Cpa And An Attorney Bb C

Tax Engagement Letters Journal Of Accountancy

How To Find The Right Cpa For Your Small Business Ramsey

Top Us Crypto Tax Attorney Cpa Avoid Irs Penalties

Considerations For Cpas Dealing With Unpaid Fees Freeman Mathis Gary

Tax Accountant Career Overview Job Description Education Requirements

Do You Need A Tax Attorney Or Cpa

My Life As A Lawyer And Cpa Uworld Roger Cpa Review

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Ea Vs Cpa What S The Difference Between These Tax Pros Smartasset